There are three types of nonprofit corporations recognized in California: religious, public benefit, and mutual benefit. While all three are different when it comes to their activities, missions, fundraising, and political activities, all three are eligible for exemption from state and federal taxes.

It is the mission of a mutual benefit corporation that sets it apart from other nonprofits. A mutual benefit corporation’s mission is to serve its own members, while religious and public benefit corporations serve the public. Some common examples of mutual benefit corporations include professional associations, homeowners’ associations, unions, chambers of commerce, social clubs, and fraternities.

There are other significant differences between mutual benefit corporations and other nonprofits, including the following:

Political activity. While the law forbids charities from participating in political activities without following stringent regulations and limitations, mutual benefit corporations are allowed more flexibility when it comes to engaging in political activity. Before doing so, however, it is always wise to consult with an attorney to avoid jeopardizing the organization’s tax-exempt status.

Fundraising. Donations made to mutual benefit corporations are generally not tax-deductible for the donor, unlike donations made to religious or public benefit nonprofits where funds are used to benefit the public instead of nonprofit members. Mutual benefit nonprofits typically raise money by charging members annual or monthly dues, while other nonprofits rely on public donations.

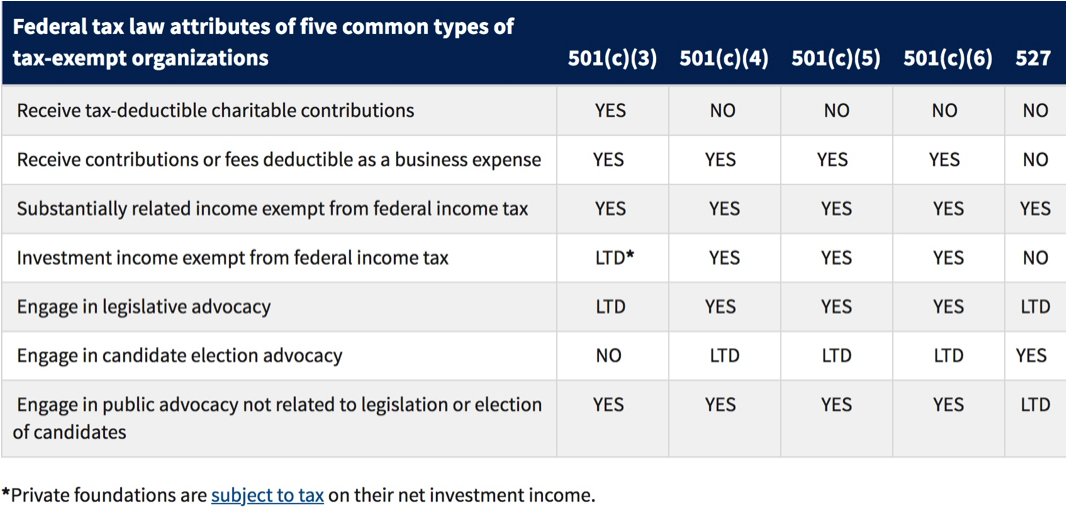

Taxes. Mutual benefit corporations typically qualify for federal tax exemption under 501(c)(4) or 501(c)(6), but they do not qualify as charitable 501(c)(3) tax-exempt organizations, which means donations to a mutual benefit corporation are not tax-deductible by their donors. The following IRS chart clarifies the federal tax law attributes of five of the most common tax-exempt organizations:

Dissolution. Once a mutual benefit corporation is dissolved, the remaining assets can be distributed to its members. This option is not available for other nonprofits.

The Church Law Center of California advises churches and other nonprofits on how to protect themselves from risk while furthering their mission. Call us today at (949) 892-1221 or reach out to us through our contact page.