The Tax Cuts and Jobs Act of 2017 imposed a new kind of unrelated business income tax (UBIT) on nonprofits that required these organizations to pay a 21% tax on the value of certain transportation-related benefits provided to employees, including parking. The so-called “Parking Tax” was repealed retroactively in December 2019 in the Taxpayer Certainty and Disaster Tax Relief Act of 2019, making it possible for nonprofits to obtain a refund of Parking Tax payments made in their annual IRS filings for 2017 and 2018.

The IRS published guidance on how nonprofits can claim a refund or credit for Parking Tax paid in 2017 and 2018. Organizations with tax returns that included IRS Form 990-T — the tax return form for UBIT — need only file an amended Form 990-T for each year in which the Parking Tax was paid to get a refund or credit. It should be noted that this process will be more complex for nonprofits that had other sources of UBIT.

For nonprofits that reported the Parking Tax as their only UBIT, the amended Form 990-T must include “Amended Return – Section 512(a)(7) Repeal” in writing at the top of the amended Form 990-T. A nonprofit must also include an attachment that explains the reason for each change; an explanation that reads “Repeal of Section 512(a)(7)” is sufficient.

Filing for a 2017 Parking Tax Refund

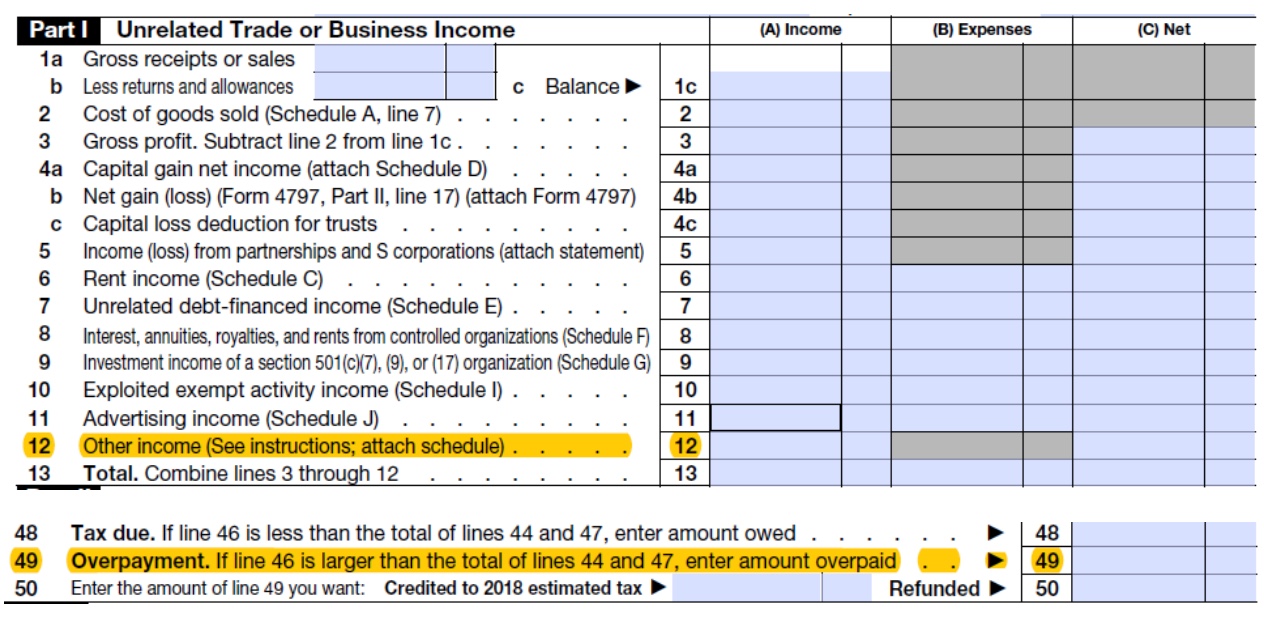

Line 12 of the 2017 Form 990-T should have been used to report expenses related to the Parking Tax. On an amended return, filers will need to reduce this line by the transportation expense amount reported on the original return. The rest of the return should then be completed based on the amended entry and any overpayment noted on line 49:

Filing for a 2018 Parking Tax Refund

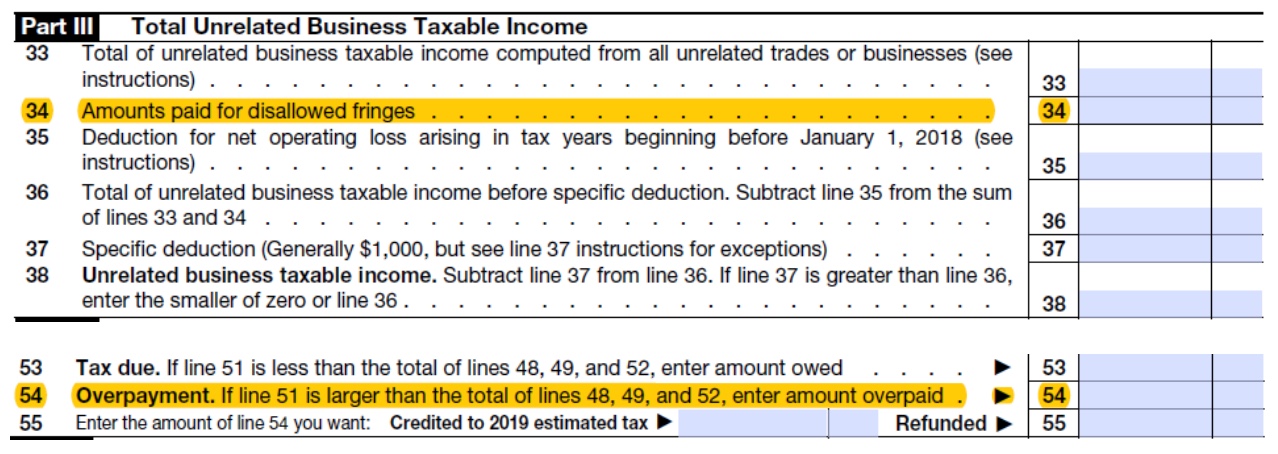

Line 34 of the 2018 Form 990-T should have been used to report expenses related to the Parking Tax. On an amended return, filers will need to enter 0 (zero). The rest of the return should then be completed based on the amended entry and any overpayment noted on line 54:

The time limits for filing these refund claims are three years from the time the original Form 990-T was filed or two years from the time the tax was paid, whichever is later.

The Church Law Center of California advises religious and secular nonprofits on governance and risk management matters. To find out how we can assist your organization, call us today at (949) 892-1221 or reach out to us through our contact page.